Simplify Your Giving with a Donor Advised Fund

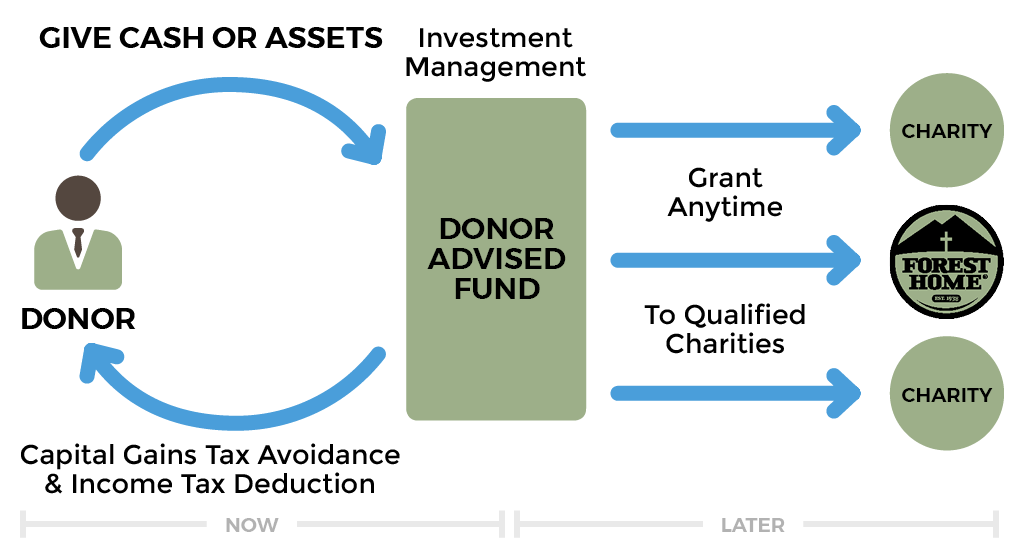

A Donor Advised Fund allows you to simply and efficiently manage your charitable giving. If you support multiple ministries or you want to secure a charitable deduction now, but give to ministries later, a donor advised fund may benefit you.

Forest Home Donor Advised Funds

Many ministry partners want to share the life-changing power of the Gospel by donating to Forest Home and also want to support other ministry organizations. Forest Home Donor Advised Funds allow you to manage your charitable giving simply and efficiently at a time that is right for you.

How it Works

1. Donor makes tax-deductible contribution to a Donor Advised Fund

2. Donor avoids capital gains tax on appreciated asset contributions

3. Investment Manager investment assets for positive returns

4. Donor recommends grants to qualified charities

Benefits

- You have several different charitable interests and want to simplify your giving with one charitable tax receipt

- You have extra income or a taxable event, but desire to make charitable gifts over several years

- You have a private foundation that you wish to terminate and send those assets to a Donor Advised Fund

- You wish to use a Donor Advised Fund to complement a private foundation (perhaps in order to give anonymously)

- For Donor Advised Funds, the tax deduction limit for gifts of cash is 60% of adjusted gross income; for a private foundation, it is only 30%

- For Donor Advised Funds, the deduction limit for gifts of stock or other assets is 30% of adjusted gross income; for a private foundation, it is only 20%

- Forest Home Foundation manages the paperwork and administrative duties

- Funds grow tax free, leveraging your ability to make more charitable gifts to ministry over time

We’re here to help

To discuss opening a Donor Advised Fund, contact us here.