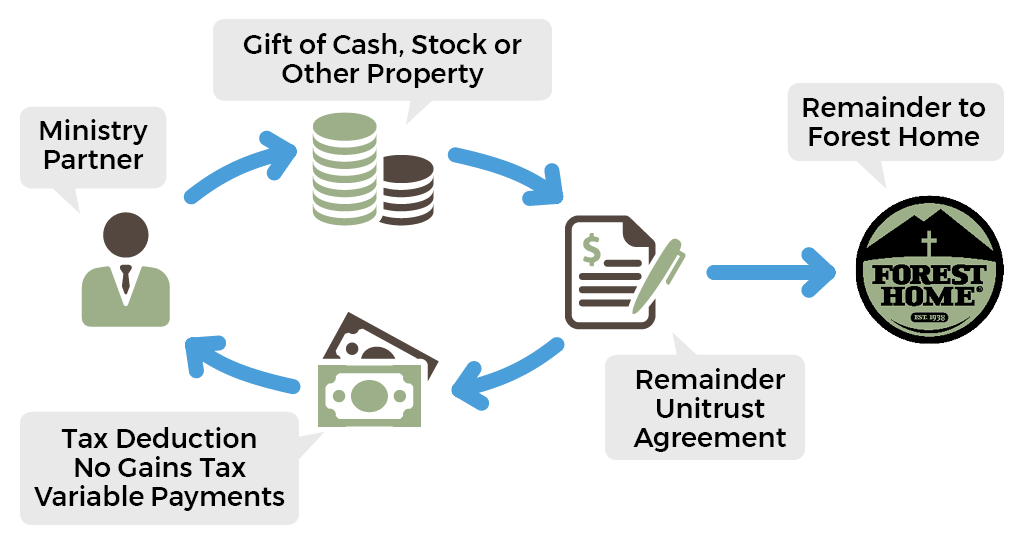

Charitable Remainder Unitrust

- Get an immediate income tax deduction

- Save on capital gains taxes

- Control your investments

- Receive income from your investments for the rest of your life

- Support ministries that have been important in your life

How would you like to be remembered? Many of our ministry partners like you tell us they want to support ministries that have been important in their life. With thoughtful planning, you too can accomplish your personal goals, increase your loved ones’ financial security and make a different for Christ beyond your lifetime.

A charitable remainder unitrust is a great way to receiving income for life or for a fixed number of years while supporting the ministries that have been important in your life. You receive an immediate income tax deduction for a portion of your contribution and save on capital gains taxes.

How it works

1. An attorney drafts a charitable remainder unitrust trust document to be reviewed by you and your professional advisors.

2. You donate $100,000 or more in cash, securities or real estate to the trust.

3. You or your designated loved ones receive payments for life (income recipients must be age 60 or older) or for a term of up to 20 years. Payments will vary based on the performance of the investments held in the trust and are based on a rate agreed upon when the trust is created (the statutory minimum is 5 percent).

4. If you donate appreciated assets to the trust, those assets can be sold and the full amount reinvested without incurring capital gains tax at the time of the transfer.

5. You may add to your trust at any time with additional gifts of cash, securities or real estate.

6. When the trust terminates – either at the death of the last income recipient or at the end of the trust term – the remaining balance will transfer to support the ministries that have been important in your life.

Benefits

- Receive income for life or a fixed number of years

- Diversifies your investment portfolio (i.e. appreciated real estate)

- Provides flexible funding options

- Receive an immediate income tax deduction for a portion of your gift, with additional carryover in subsequent years

- No capital gains tax is due at the time of transfer on any appreciated assets

- Gives you the joy of knowing that you are multiplying your impact for Christ

More Information

A standard unitrust is designed to pay you income as a fixed percentage of principal. Payments from a standard unitrust begin as soon as the trust is created and funded. Alternatively, you can establish a “FLIP” unitrust. This type of gift allows you to grow your assets, avoid the capital gains cost of a sale, and defer income payments based on a future event as a hedge against inflation.